Social Security Tax Limit 2025 Withholding Chart

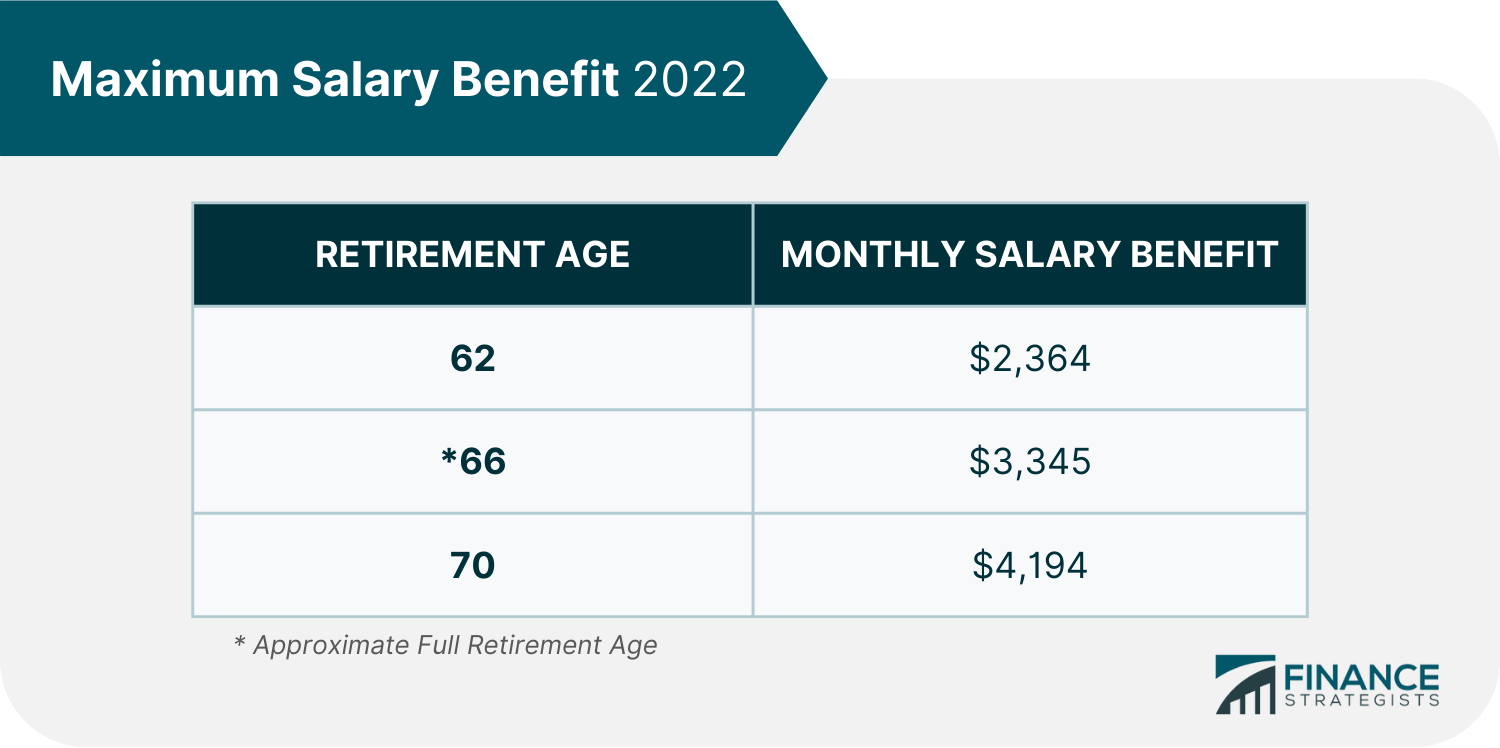

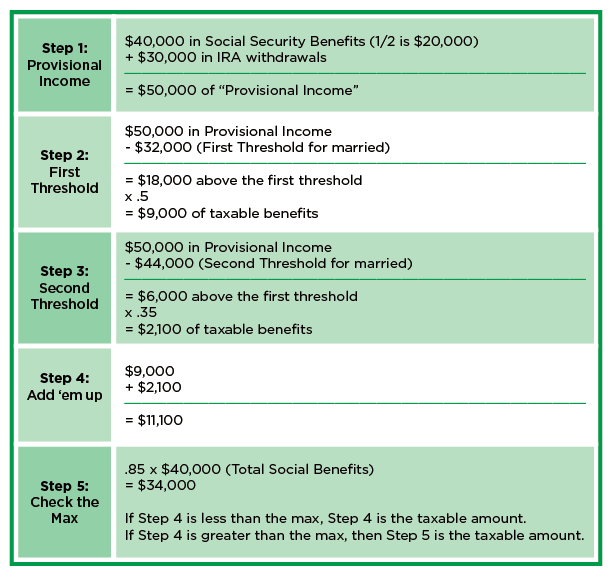

BlogSocial Security Tax Limit 2025 Withholding Chart. Social security benefits include monthly retirement, survivor and disability benefits. Up to 50% of your social security benefits are taxable if:

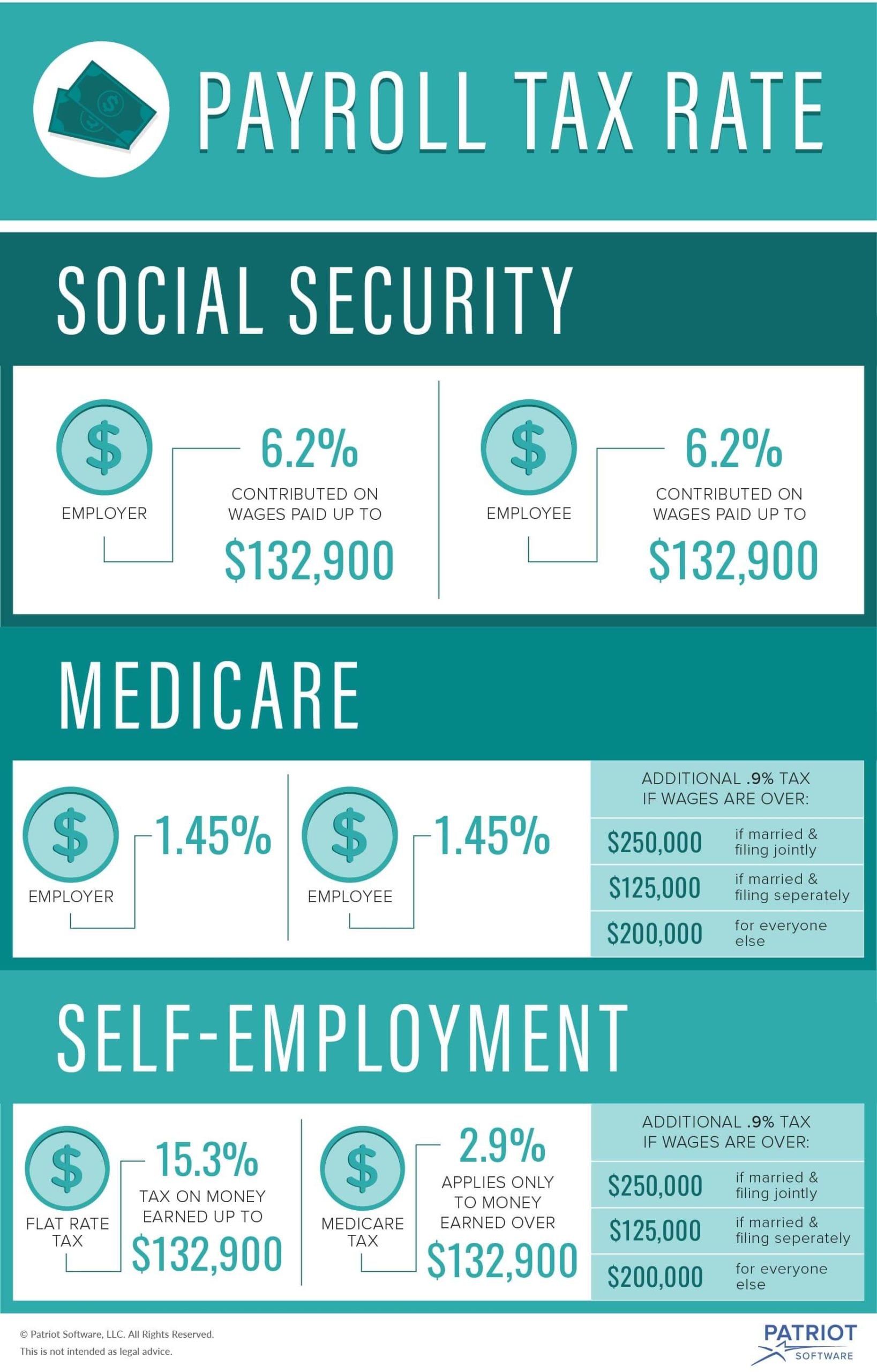

Thus, an individual with wages equal to or larger than $168,600. Social security and medicare tax for 2025.

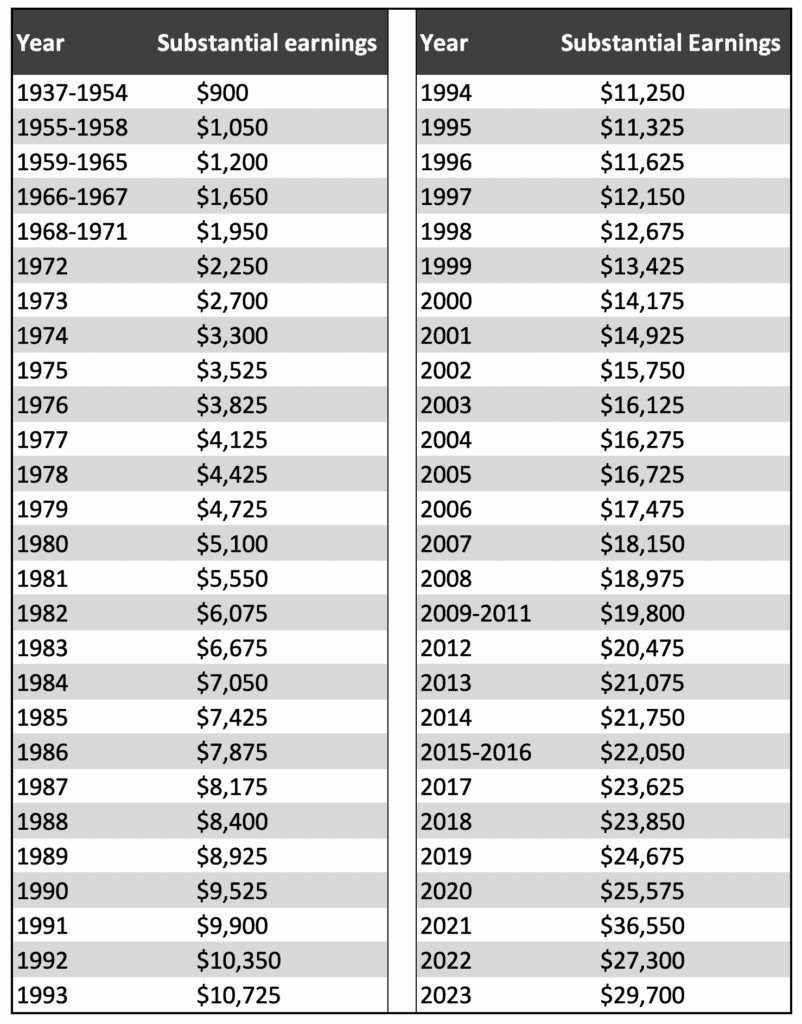

Social Security Tax Limit 2025 Withholding Table Adora Ardelia, Social security income tax limit 2025 calendar. We raise this amount yearly to keep pace with increases in average wages.

Social Security Limit 2025 Irs Ree Lenora, Five things to know about social security and taxes; The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Max Taxable For Social Security 2025 Sarah Cornelle, For 2025, the maximum amount that can be. Up to 50% of your social security benefits are taxable if:

Maximum Withholding Social Security 2025 Marty Hendrika, Social security tax limit jumps 5.2% for 2025; You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

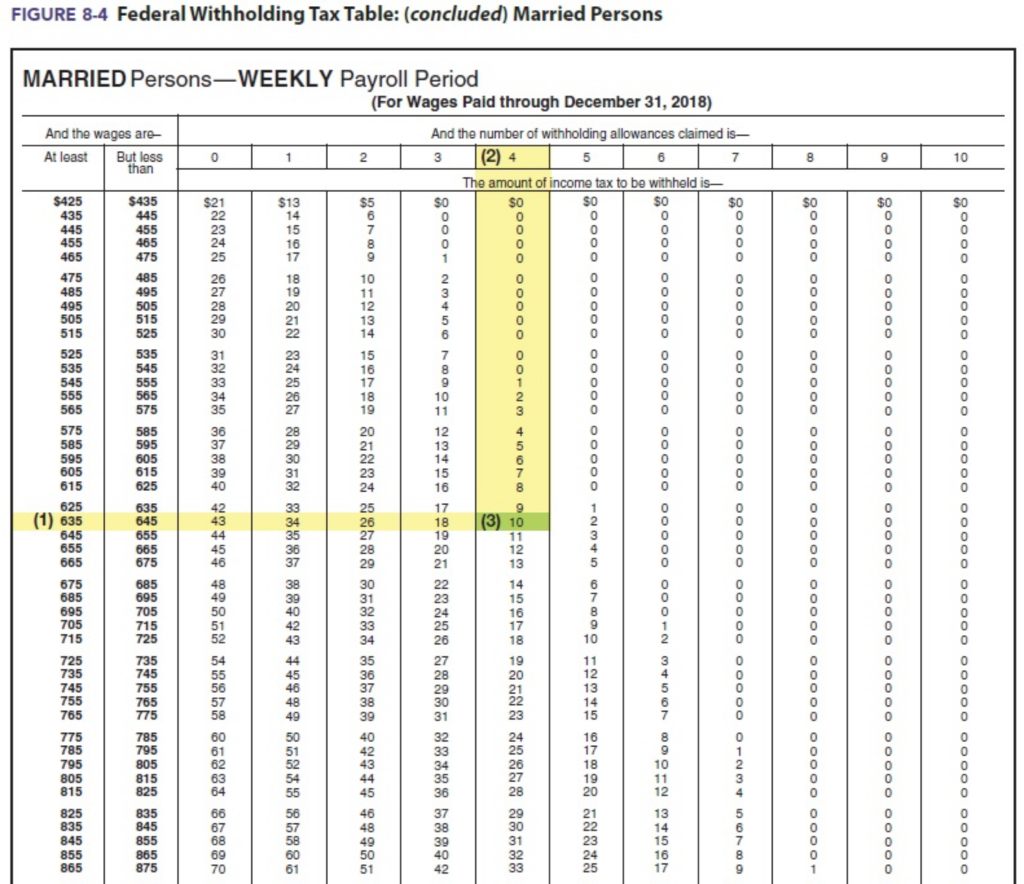

Social Security Tax Limit 2025 Withholding Chart Elsa Suzanne, In 2025, the social security tax limit rises to $168,600. What’s the maximum you’ll pay per employee in social security tax next year?

What Is The Social Security Tax Rate For 2025 Madge Rosella, In 2025, the social security tax limit rises to $168,600. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you:

Max Taxed For Social Security 2025 Sukey Engracia, For 2025, the maximum amount that can be. Filing single, head of household or qualifying widow or widower with more than $34,000 income.

Ssi Household Limits 2025 Sonja Eleonore, Filing single, head of household or qualifying widow or widower with more than $34,000 income. We raise this amount yearly to keep pace with increases in average wages.

Social Security Earnings Limit For 2025 Eda, (for 2025, the tax limit was $160,200. For 2025, the maximum amount that can be.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Social security tax limit jumps 5.2% for 2025;